Arbitrum (ARB) Price Prediction 2025-2028: Ethereum Layer-2’s Rising Star

What Is Arbitrum and Why It Matters in Ethereum Layer-2

Arbitrum is a prominent Ethereum Layer-2 scaling solution designed to make Ethereum transactions faster and cheaper. In a nutshell, it operates using optimistic rollups – bundling many operations off-chain and then settling them on Ethereum for security. This allows Arbitrum to handle more transactions per second with much lower fees than Ethereum’s base layer. The ARB token is Arbitrum’s governance token, empowering holders to vote on protocol upgrades and decisions. While ARB isn’t used for gas fees (you still pay Ethereum gas in ETH on Arbitrum), it represents a stake in the ecosystem’s growth and direction. Arbitrum’s significance comes from being one of the largest and most active Layer-2 networks, often boasting the highest Total Value Locked (TVL) among Ethereum’s scaling platforms. Developers and users are drawn to Arbitrum for its fast throughput and low costs, making it a crucial piece of Ethereum’s roadmap to scalability. In summary, Arbitrum is a rising star in the crypto world because it enhances Ethereum’s usability without compromising security, and the ARB token lies at the heart of its decentralized governance.

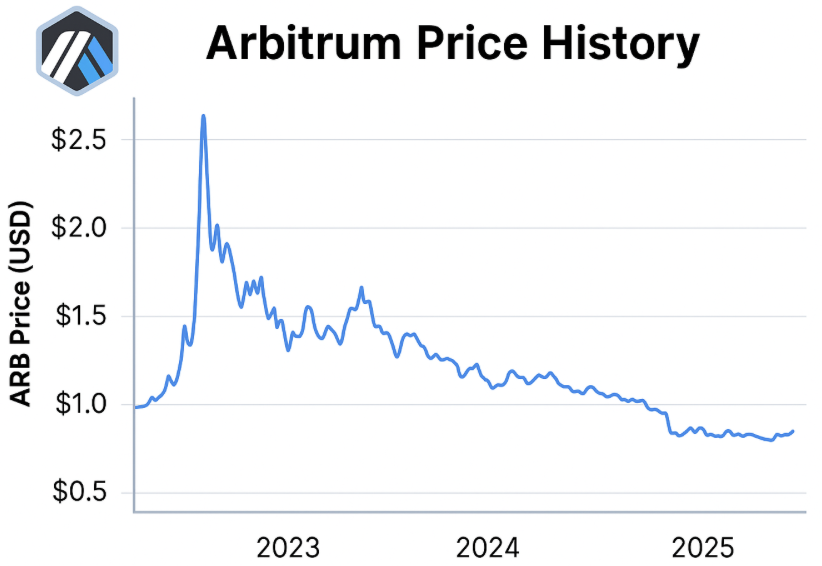

ARB Historical Price Performance from Launch to Present

Arbitrum’s ARB token launched in March 2023 amid enormous hype. In fact, early trading was so frenzied that ARB briefly spiked to astonishing levels (some initial trades recorded prices above $8!). However, that initial burst was short-lived – within hours the price settled into the $1–2 range as the market found equilibrium after the airdrop. Throughout 2023, ARB traded mostly between $1 and $1.5, reflecting a period of price discovery and broader bear-market conditions. By early 2024, optimism returned: ARB rallied alongside the crypto market, peaking around $2.40 in January 2024. This surge corresponded with growing usage of Ethereum Layer-2 networks and bullish sentiment around Arbitrum’s technology.

The celebration didn’t last forever. As 2024 progressed, ARB’s price faced selling pressure from profit-taking and large token unlocks. By mid-2024, ARB retraced down to the ~$0.50 range, hitting a low around $0.43 during a market-wide downturn. Interestingly, November 2024 brought a relief rally – ARB nearly doubled from its lows to about $0.97 as crypto markets bounced back. But as the calendar turned to 2025, macroeconomic worries and increased token circulation pushed ARB into a downtrend again. In April 2025, ARB marked a new all-time low near $0.24, shocking early investors with over 90% drawdown from its launch euphoria. The good news is that since that bottom, ARB has been recovering. As of mid-2025, ARB hovers around $0.40–$0.45, showing resilience and attracting traders who believe the worst may be over. This volatile journey from launch to present highlights how young and news-driven the ARB token still is. Arbitrum price prediction analyses now hinge on whether ARB can build on this recovery momentum.

Short-Term Arbitrum Price Prediction (2025–2026)

In the short term, Arbitrum’s price prediction for 2025 and 2026 appears cautiously optimistic. Technical analysis hints that ARB may have formed a firm bottom in the $0.25–$0.30 range in early 2025. This zone now serves as a strong support level, barring any unforeseen negative news. Market sentiment on ARB has improved from extreme fear to a more neutral-to-bullish stance as the token climbed back above $0.40. Traders on Gate.com and other exchanges have noted higher lows forming on ARB’s price chart – a classic sign of a trend reversal. If this uptrend continues, ARB could retest resistance around $0.50 (a psychological level and roughly where it broke down from in early 2025). A break above $0.50, especially on strong trading volume, might ignite FOMO (fear of missing out) among traders, potentially propelling ARB toward the next target around the $1.00 mark.

Technical indicators currently paint a mixed but hopeful picture. ARB’s 50-day moving average is curling upward, suggesting positive short-term momentum, though it remains below the 200-day MA (the long-term trend indicator) which hovers around $0.50–$0.60. A bullish crossover of these averages in late 2025 could be a catalyst for more gains. The Relative Strength Index (RSI) for ARB has been recovering from oversold territory, sitting in a comfortable mid-range now – not overbought yet, which leaves room for further upside. Market sentiment analysis on crypto forums and social media indicates that many investors are regaining confidence in Layer-2 tokens. Ethereum’s successful upgrades and increasing usage of Arbitrum network can improve sentiment further. Short-term Arbitrum forecast ranges widely, but a common conservative prediction is ARB reclaiming the $0.80 to $1.00 range by the end of 2026, assuming a broader crypto market recovery. This would mean ARB roughly doubling from current prices over the next 18 months – an achievable feat if development on Arbitrum remains strong and Ethereum’s next bull cycle kicks in. Of course, volatility is the norm in crypto: if Bitcoin and Ethereum stumble, ARB could revisit support around $0.30. Overall, though, the ARB token is showing signs of life, and many traders expect gradual gains in the 2025–2026 period.

Long-Term Arbitrum Price Prediction (2027–2028)

Looking further ahead, the long-term Arbitrum forecast for 2027 and 2028 envisions substantial growth – albeit with some big assumptions. By 2027–2028, Ethereum’s roadmap (including potential sharding and continued rollup adoption) could significantly boost Layer-2 networks like Arbitrum. If Ethereum’s user base expands and congestion returns to L1, Arbitrum stands to benefit as a proven scaling solution. Increased network activity on Arbitrum would not directly demand ARB tokens for gas, but it would likely improve the ecosystem’s visibility and could spur governance participation, indirectly adding demand for ARB tokens as investors bet on the ecosystem’s success. Many analysts believe that by 2027, ARB will have recovered to its early 2023 launch levels and beyond. For instance, some forecasts put ARB in the ballpark of $1.5 to $2.0 by 2027, which aligns with a scenario where Arbitrum maintains its dominance among Ethereum Layer-2 solutions.

By 2028, as crypto markets mature, ARB could climb further if several favorable factors converge. One major factor is broader adoption: if mainstream users and major dApps are using Arbitrum under the hood, the value proposition of ARB as a governance token might rise. Additionally, the ARB token’s supply dynamics will play a role – the initial token allocation and vesting schedules mean that by 2028 most of the planned 10 billion ARB supply will be circulating. After heavy inflation in the first years, the token emission should taper off, potentially reducing sell pressure. Assuming a bullish macro environment (and no existential regulatory shocks to crypto), ARB could potentially reach new highs in 2028. Some optimistic predictions even target the $2 to $3 range for ARB in 2028, implying roughly a 5x increase from mid-2025 prices. This would require Arbitrum continuing to innovate and retain a large share of Layer-2 usage against competitors (like Optimism, zkSync, and others). It’s worth noting that long-term crypto predictions are highly speculative. Risks remain: a superior technology could supersede Arbitrum, or general crypto market cycles could depress prices. Nevertheless, with Ethereum likely still relying on rollups in 2028, Arbitrum is poised to be a key player. If it delivers on growth expectations, an ARB price of around $2 (give or take) is plausible by 2027-2028. In a more aggressive scenario where the crypto market enters a strong new bull phase, ARB could even push toward its theoretical highs (some extreme forecasts eye $3+), but for now, a safer long-term bet is steady growth to the lower-single-digit dollars.

Final Thoughts

Arbitrum has quickly become a cornerstone of Ethereum’s scaling journey, and its ARB token reflects both the promise and volatility of emerging crypto technologies. We’ve seen ARB soar with optimism and crash with market fear, all in a relatively short span. A professional yet slightly fun takeaway is that riding ARB’s price is a bit like a rollercoaster – not for the faint of heart, but potentially thrilling for those who believe in Ethereum Layer-2’s future. In the short term, caution and patience are key; ARB may take time to regain lost ground. In the long term, if Ethereum’s ecosystem keeps growing, Arbitrum is well-positioned to capture that growth, which could make today’s prices look like a bargain in hindsight. As always in crypto, do your own research, stay safe, and only invest what you’re willing to potentially lose – but it’s okay to dream a little about the Layer-2 future too!

On Gate.com, ARB is actively traded, giving investors a chance to easily get in on the action of this Layer-2 powerhouse. With Arbitrum’s strong technology and community, the ARB token’s journey is just beginning. Keep an eye on this project – whether you’re an Ethereum enthusiast, a trader hunting for the next big opportunity, or just along for the Layer-2 ride, Arbitrum is an adventure worth watching. Here’s to seeing how this Arbitrum price prediction plays out in 2025, 2028, and beyond – may the Layer-2 odds be ever in our favor!

Hedera Hashgraph (HBAR): Founders, Technology, and Price Outlook to 2030

Cardano (ADA): A History, Tech Overview, and Price Outlook

Jasmy Coin: A Japanese Crypto Tale of Ambition, Hype, and Hope

Solana Price in 2025: SOL Token Analysis and Market Outlook

2025 Bitcoin (BTC) Price Prediction: Can It Break Through $200,000?

Internet Computer (ICP) coin analysis and price outlook for 2025

Title: Exploring The Impact of Dark Pool Trading in Cryptocurrency Markets

Understanding Governance Tokens: Exploring Decentralized Finance in Web3

Discover Exciting New NFT Ventures for 2024

Unlocking the Potential of Ethereum Name Service: A Comprehensive Guide

Comprehensive Guide to the MONKY Token in the Web3 Ecosystem